GST Management

What is GST

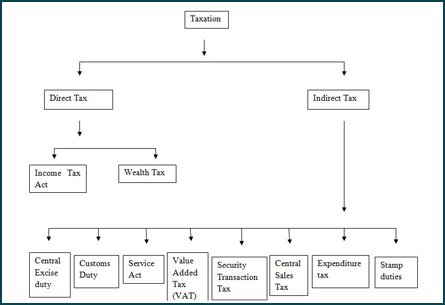

GST is an Indirect Tax which has replaced many Indirect Taxes in India. The Goods and Service Tax Act was passed in the Parliament on 29th March 2017. The Act came into effect on 1st July 2017; Goods & Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition.

In simple words, Goods and Service Tax (GST) is an indirect tax levied on the supply of goods and services. This law has replaced many indirect tax laws that previously existed in India. GST is one indirect tax for the entire country.

Value Addition

There are multiple change-of-hands an item goes through along its supply chain: from manufacture to final sale to the consumer. Let us consider the following case:

- Purchase of raw materials

- Production or manufacture

- Warehousing of finished goods

- Sale to wholesaler

- Sale of the product to the retailer

- Sale to the end consumer

Goods and Services Tax will be levied on each of these stages which makes it a multi-stage tax.

Multi-stage Tax

The manufacturer who makes biscuits buys flour, sugar and other material. The value of the inputs increases when the sugar and flour are mixed and baked into biscuits. The manufacturer then sells the biscuits to the warehousing agent who packs large quantities of biscuits and labels it. That is another addition of value after which the warehouse sells it to the retailer.

The retailer packages the biscuits in smaller quantities and invests in the marketing of the biscuits thus increasing its value. GST will be levied on these value additions i.e. the monetary worth added at each stage to achieve the final sale to the end customer.

Get the latest web design, development & SEO tips to grow your business!

Our Client